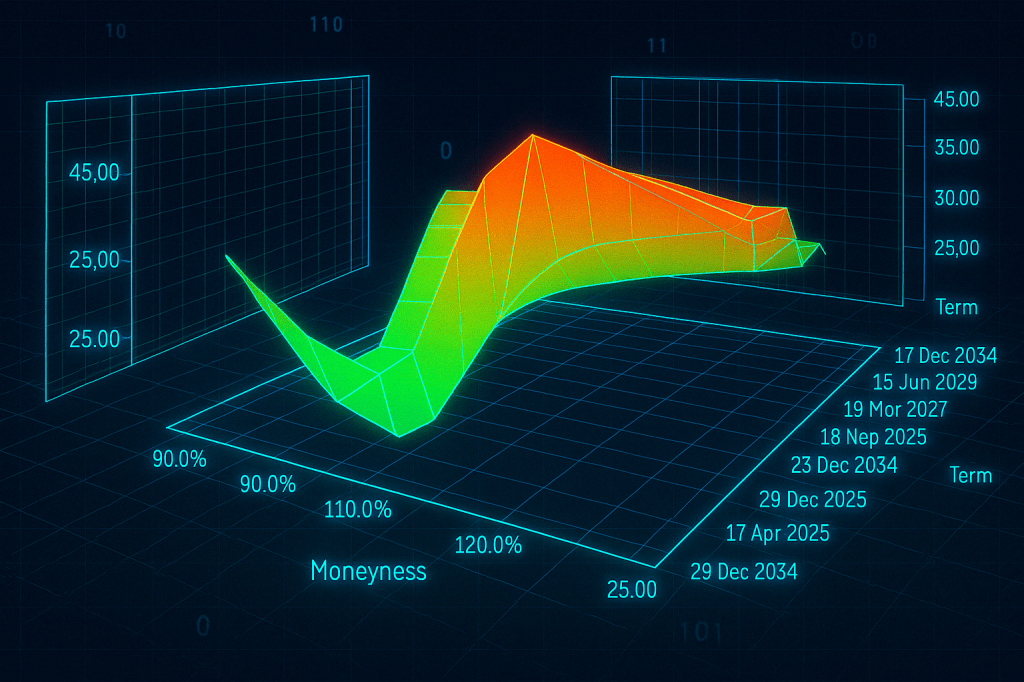

The financial markets often provide deep insights into investor sentiment, particularly through the lens of derivatives pricing. The ongoing corporate transaction between Banco Sabadell (SAB) and Banco Bilbao Vizcaya Argentaria (BBVA) has generated significant market interest, with options pricing revealing a stark divergence in expectations. While it is common to observe a volatility skew—where implied volatility (IV) for out-of-the-money (OTM) puts is higher than OTM calls—Banco Sabadell’s IV surface is showing an anomaly: a volatility peak in the OTM call side, signaling a potential upward surge in its stock price.

This unusual pricing dynamic suggests that market participants are anticipating a successful acquisition by BBVA, a scenario that could significantly impact both banks’ valuations. In this article, I analyze the implications of the IV skew and what it reveals about the evolving M&A process.

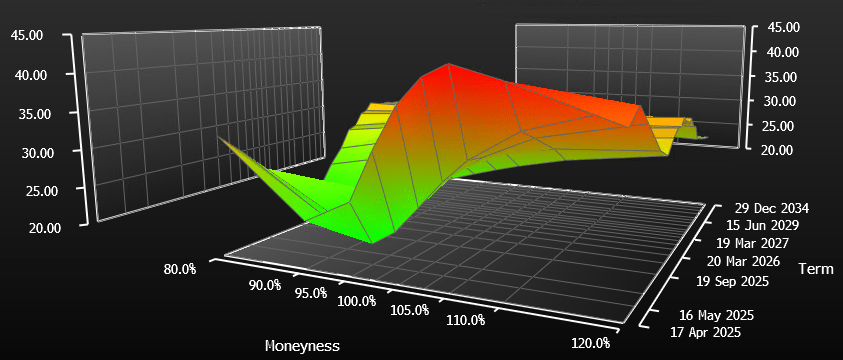

SAB (Bloomberg Terminal @ 27.03.2025)

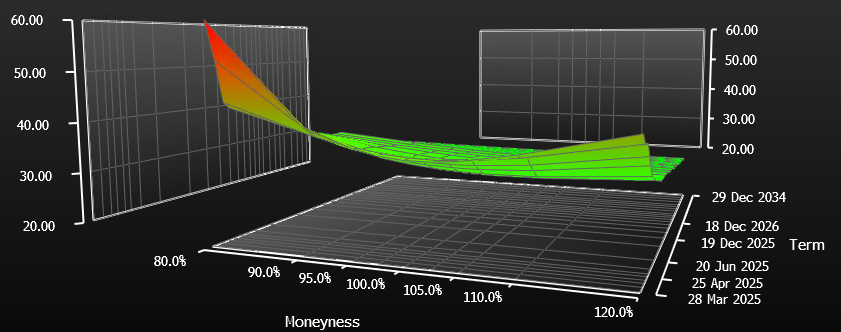

BBVA (Bloomberg Terminal @ 27.03.2025)

Understanding the Implied Volatility Surface

The implied volatility surface is a three-dimensional representation of IV based on three factors:

1. Strike Price vs. IV: Shows whether OTM puts or calls have higher implied volatility.

2. Time to Expiry vs. IV: Highlights whether near-term or long-term options are experiencing heightened demand.

3. IV Across Different Expirations: Helps in understanding how market sentiment shifts over time.

For most stocks, particularly in the financial sector, OTM puts tend to have higher IV than OTM calls, reflecting investors’ demand for downside protection. However, the IV surface of Banco Sabadell contradicts this standard pattern, exhibiting a volatility peak on the OTM call side, indicating heightened expectations of an upward move.

What the IV Skew Tells Us About the BBVA-Sabadell Deal

1. Bullish Market Sentiment on Banco Sabadell

The higher IV in OTM call options suggests that traders are actively positioning for a significant upward move in Banco Sabadell’s stock price. This could be driven by speculation that the BBVA acquisition will succeed and that Sabadell shareholders will receive a favorable deal.

Typically, a rise in IV for calls happens when:

• Investors expect positive news that could drive the stock price higher.

• Market participants are hedging or speculating on a breakout move.

• There is a potential short squeeze or strategic positioning ahead of a key event.

2. BBVA’s More Traditional Skew Suggests Cautious Positioning

Unlike Banco Sabadell, BBVA maintains a traditional IV skew with higher IV on OTM puts, suggesting investors are concerned about potential downside risks. Given BBVA’s size and the regulatory complexities involved, the acquisition comes with significant execution risks.

Regulatory scrutiny is one of the key concerns, with the Spanish competition authority (CNMC) initiating an extended review of the acquisition. This review could take at least three additional months to resolve, creating uncertainty in BBVA’s stock price performance. As a result, traders may be purchasing OTM puts to hedge against a potential decline if the deal faces unexpected hurdles.

Regulatory Uncertainty: A Key Driver of Volatility

The European Central Bank (ECB) has already approved the deal, marking an important milestone in the process. However, Spain’s competition regulator is closely examining whether BBVA’s acquisition of Banco Sabadell could lead to an excessive concentration of market power, particularly in SME lending and regional banking markets.

Additionally, concerns about BBVA’s exposure to emerging markets like Mexico have been raised, adding another layer of risk. These factors contribute to the divergence in volatility pricing between the two banks, with BBVA reflecting more downside risk while Banco Sabadell reflects significant upside speculation

How Traders Can Interpret This Volatility Anomaly

For options traders and institutional investors, the skew differences between Banco Sabadell and BBVA provide actionable insights:

• Bullish on Banco Sabadell: Investors buying OTM calls are betting on a favorable outcome, believing that the deal will materialize successfully and drive Sabadell’s stock price higher.

• Hedging Against BBVA Downside: The traditional skew in BBVA suggests that some investors are protecting themselves against potential negative outcomes, such as regulatory hurdles, deal failure, or dilution concerns.

• Event-Driven Trading: The volatility divergence creates potential arbitrage opportunities for event-driven hedge funds, who may seek to capitalize on implied volatility discrepancies.

Conclusion: The Options Market Speaks

The divergence in the implied volatility surfaces of Banco Sabadell and BBVA reflects the market’s anticipation of a major corporate shift. The rare positive skew in Banco Sabadell’s IV suggests that investors are pricing in a strong likelihood of the acquisition succeeding, potentially leading to a significant stock price rally. Meanwhile, BBVA’s traditional skew indicates that market participants are still cautious about the risks involved.

Daniel Rivas

Leave a comment