Introduction: Focusing on What Matters

In a world where market headlines dominate the daily news cycle, it’s easy for investors to get caught up in short-term price movements and sentiment shifts. But behind the noise, the true driver of long-term stock performance lies in the fundamentals—specifically, the growth of free cash flow per share (FCF/share).

Over extended periods, the compound annual growth rate (CAGR) of a stock’s price tends to converge with the CAGR of its FCF/share. This relationship underscores a foundational principle of value investing: focus on cash-generative businesses with durable economics, and let time and compounding do the rest, or in Charlie Munger´s own words: “Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it.”

Short-Term Volatility vs. Long-Term Value

Stock prices can swing wildly in the short term due to investor sentiment, macro uncertainty, or speculation. However, these fluctuations are often disconnected from the actual performance of the business, as we have seen all along the current year. Over time, valuation multiples tend to normalize, and stock price performance realigns with the underlying company’s ability to generate free cash flow.

The Math Behind the Connection

Let’s define two key metrics:

- FCF/share CAGR: The annualized growth rate of free cash flow per share.

- Stock Price CAGR: The annualized growth rate of the company’s stock price.

These two variables tend to be closely related over long time horizons. If a company consistently grows its FCF/share and maintains a stable valuation multiple (such as price-to-FCF), the stock price should rise at a similar rate:

Because valuation multiples typically revert to the mean, the dominant force behind long-term price appreciation is free cash flow growth.

Real-World Examples: When Free Cash Flow Drives Long-Term Value

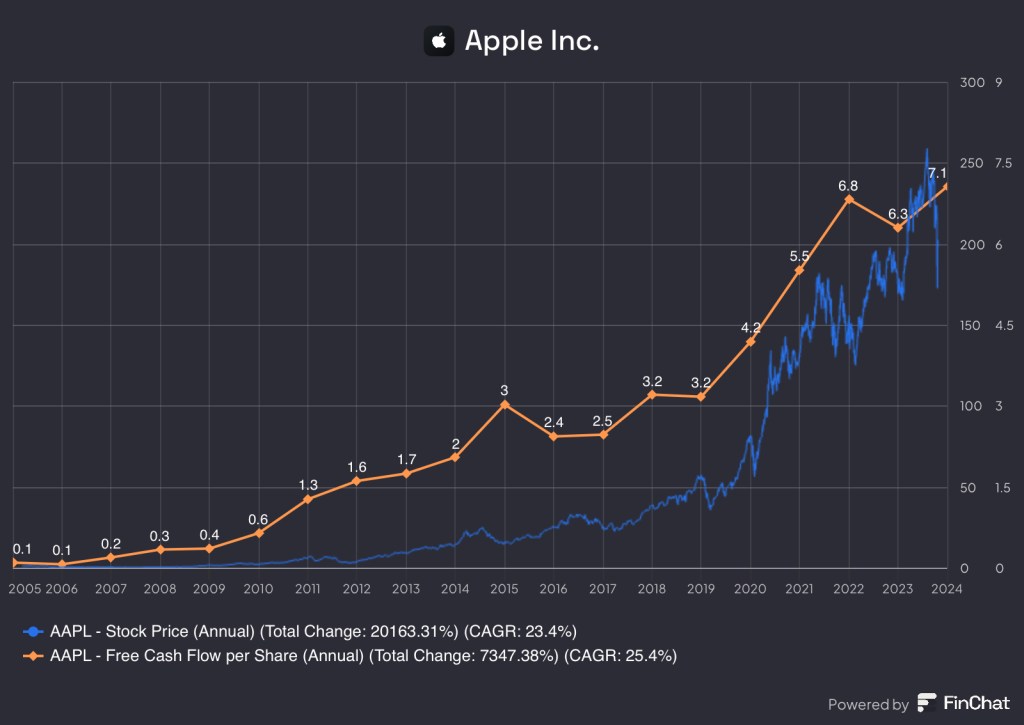

Apple Inc. (AAPL)

Apple exemplifies how long-term FCF/share growth and stock performance can move in near lockstep. From 2005 to 2024, Apple’s FCF/share grew at a 25.4% CAGR, while its stock price CAGR reached 23.4%. Despite short-term dips and sentiment swings, the consistent increase in free cash flow per share has underpinned shareholder returns. Apple’s product innovation, pricing power, and capital return programs make it a textbook case for long-term investing focused on fundamentals.

Microsoft Corporation (MSFT)

Microsoft’s transformation from a traditional software giant to a cloud-first business has fueled a continuous growth in FCF. Between 2005 and 2024, Microsoft’s FCF/share grew at 10.6% CAGR, with a stock price CAGR of 7.8%. Notably, the sharp uptick in both metrics post-2016 highlights the market’s realignment with the company’s improving fundamentals. Though price growth lagged slightly, this reinforces the point that valuation re-rating takes time—but ultimately, free cash flow wins.

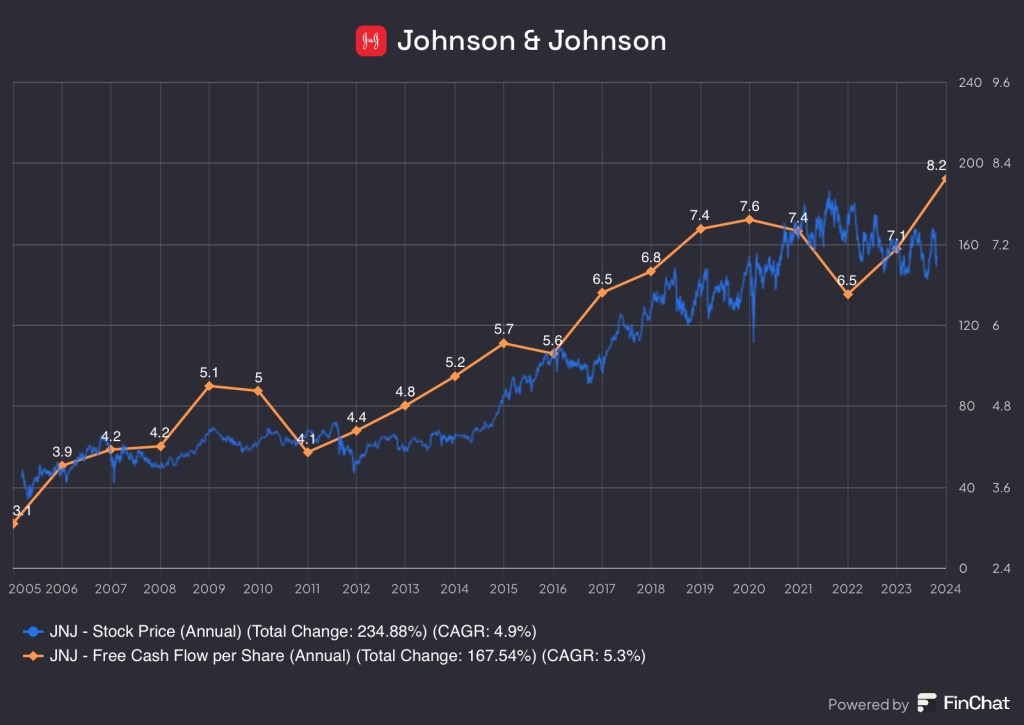

Johnson & Johnson (JNJ)

JNJ shows a slower but steady compounding story. Its FCF/share CAGR of 5.3% is matched by a stock price CAGR of 4.9% over the same period. This consistency makes it attractive to long-term value investors seeking reliable returns with lower volatility. Despite periods of flat price performance, the steady free cash flow growth serves as a stabilizing force and reflects the resilience of its diversified healthcare portfolio.

PepsiCo, Inc. (PEP)

PepsiCo delivers another example of fundamental performance translating into stock appreciation. From 2005 to 2024, its FCF/share grew at 4.1% CAGR, while its stock price CAGR was 5.6%. While FCF growth was more modest, the correlation over time remains clear. PepsiCo’s strength lies in its global brands, pricing power, and consistent dividends—which combine to create predictable, if unspectacular, long-term returns.

Conclusion: The Long Game Wins

In investing, the temptation to react to short-term market signals is strong. But lasting success comes from staying focused on business performance, not price action. The alignment between FCF/share growth and stock price CAGR shows that over the long run, fundamentals win.

By tuning out the market’s daily chatter and prioritizing quality companies with durable cash flow growth, investors can build portfolios that compound wealth over decades, not days.

Daniel Rivas

Leave a comment