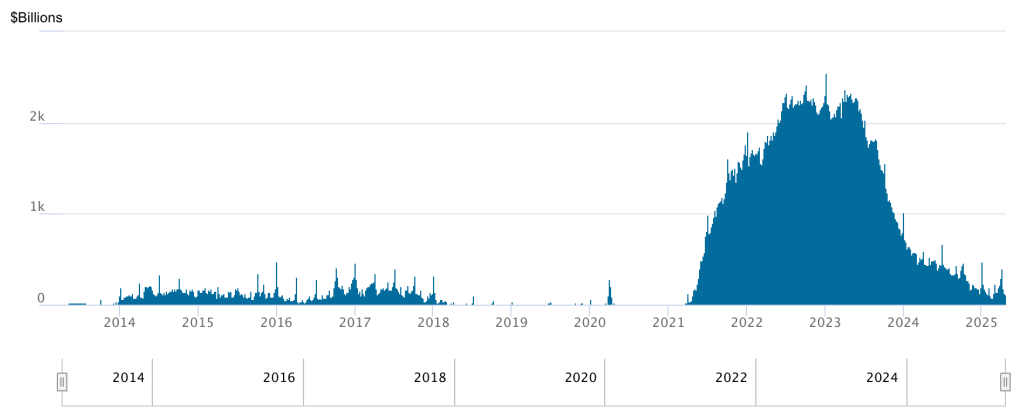

On April 16, 2025, the Federal Reserve’s Overnight Reverse Repurchase Agreement (ON RRP) facility usage declined by $34 billion to just $54.8 billion, the lowest reading since April 2021. This marks a near-complete drawdown from its all-time high of over $2.5 trillion in late 2022. As the usage of this facility approaches zero, the signal it sends is far more than technical. For those closely monitoring system liquidity, the accelerating drawdown in the ON RRP is a key inflection point, signaling a fundamental shift in the U.S. monetary system’s liquidity regime.

While short-term funding markets remain orderly and benchmark rates stable, the decline in reverse repo usage points to deeper structural changes in the financial plumbing. At this stage of the cycle (with quantitative tightening (QT) ongoing, reserve balances migrating, and the Treasury increasing bill issuance) the RRP’s collapse deserves close scrutiny.

From Liquidity Overflow to Drain

The ON RRP facility was originally expanded in the aftermath of the Global Financial Crisis as a tool to help the Fed set a firm floor under overnight interest rates in a regime of excess reserves. But its usage surged during the pandemic-era policy response, as money market funds (MMFs) found themselves flush with cash, unable or unwilling to lend to private counterparties, and with limited short-duration assets offering positive real yields. The Fed’s RRP facility, offering a risk-free overnight rate and unlimited capacity, absorbed this excess, peaking at $2.55 trillion in December 2022.

Reverse Repo Operations (2014-2025) source: https://www.newyorkfed.org/markets/desk-operations/reverse-repo

That dynamic has reversed with startling speed. In less than 18 months, daily usage has declined by over 97%. This is not merely a function of MMF preferences; it reflects a wholesale transformation in system-wide liquidity, Treasury issuance patterns, and the balance between public and private short-term instruments.

Drivers of the Collapse

Several structural forces are contributing to the sharp decline in RRP usage:

1. Quantitative Tightening and Reserve Redistribution

The Fed’s QT program, running at a pace of up to $95 billion per month, continues to reduce the asset side of the Fed’s balance sheet, draining reserves from the banking system. As Treasury securities roll off, commercial banks are forced to absorb the liquidity burden. What was once parked at the Fed by MMFs is now finding its way into reserves and deposits, compressing excess reserve buffers.

2. Elevated T-Bill Issuance and Yield Competition

In 2023 and 2024, the U.S. Treasury ramped up bill issuance to rebuild its cash balance and fund large deficits. This introduced a significant volume of attractive short-term securities into the market. Front-end Treasury bills have consistently offered yields above the ON RRP’s 5.30% rate, creating a compelling arbitrage for MMFs. As a result, cash has steadily rotated out of the RRP and into T-bills, steepening the short end of the curve and reducing the facility’s relevance.

3. Rebound in Private Repo and Collateral Demand

With improved market conditions and increased collateral availability, the attractiveness of private repo has also rebounded. Broker-dealers and clearinghouses are more active, and the general collateral (GC) repo market is functioning efficiently. This encourages MMFs to lend directly in repo markets rather than rely on the Fed facility, especially when those private arrangements offer higher yields.

Implications of RRP Approaching Zero

In theory, a zero RRP balance simply reflects a system that has transitioned from surplus liquidity to one where cash has found more productive (or higher-yielding) opportunities. But in practice, the complete depletion of the facility may be a signal that the system’s aggregate reserve level is nearing the “ample-scarce” inflection point.

If QT continues without adjustment and both RRP and excess reserves are drained simultaneously, the system may enter a regime of reserve scarcity. In such an environment, short-term funding rates (e.g., SOFR) may begin to rise relative to the Fed’s target range, reflecting upward pressure from reserve competition. The 2019 repo episode stands as a reminder of how quickly such stress can manifest.

Policy Signaling and QT Calibration

Chair Powell has consistently stated that the Fed will slow or halt QT as it approaches the point of “ample reserves,” though the definition remains intentionally vague. A fully depleted RRP facility may act as an unofficial benchmark for this threshold. While it doesn’t automatically signal liquidity stress, it implies that further QT would begin drawing down reserves directly.

In recent FOMC minutes, there has been increasing acknowledgment that QT tapering could begin “later this year,” and market participants are beginning to price in the possibility that QT could conclude as early as Q3 2025. The collapse in RRP usage adds weight to that view.

However, the Fed must carefully balance this technical shift with its policy stance. Reducing or halting QT too soon may be seen as a dovish pivot unless clearly communicated as a technical adjustment to preserve smooth market functioning.

Broader Market Consequences

While the ON RRP itself is a backstage operation, its trajectory affects a broad range of asset classes:

T-Bills and MMFs: A fully depleted RRP means MMFs will compete more aggressively for T-bills, potentially compressing yields and altering demand-supply dynamics at the front end. Repo Markets: Collateral scarcity and reserve competition could drive volatility in the GC and tri-party repo space, raising costs for leveraged participants. Funding Spreads and Liquidity Metrics: A rise in SOFR-OIS or a widening of FRA-OIS could signal growing funding tightness — a canary in the coal mine for broader liquidity stress. Risk Asset Implications: If reserve scarcity drives volatility in short-term rates or triggers a Fed reaction (QT slowdown), that may have knock-on effects across the curve and into risk assets. Tighter liquidity generally precedes lower risk tolerance.

Conclusion

The ongoing decline in the ON RRP facility is not just a technicality — it is a high-frequency, forward-looking indicator of liquidity regime change. A tool that once absorbed trillions in excess liquidity is on the verge of irrelevance, and that in itself is a powerful signal. As the RRP approaches zero, the burden of liquidity management shifts back onto the reserve system, increasing the risk of friction.

For portfolio managers, traders, and macro strategists, now is the time to reassess assumptions about abundant liquidity. The system is evolving — quietly, but decisively — and the next phase may prove far less forgiving for those who fail to read the plumbing.

Daniel Rivas

Leave a comment