In an era of elevated borrowing costs, regulatory headwinds for banks, and geopolitical uncertainty, private equity sponsors are increasingly turning to unitranche financing to gain what traditional capital markets can no longer guarantee: speed, certainty, and flexibility. While not new, the unitranche loan has re-emerged as a strategic tool for dealmakers navigating volatile conditions.

The Rise, Fall, and Return of Unitranche

Unitranche loans first gained traction in the mid-2010s, particularly in U.S. middle-market transactions. By blending senior and subordinated debt into a single tranche, the structure offered a streamlined alternative to the traditional model. As syndicated markets grew more efficient and yields compressed, unitranche briefly faded from prominence. But 2023–2025 has brought a new set of market dynamics: hawkish central banks, risk-off credit sentiment, and reduced bank lending appetite.

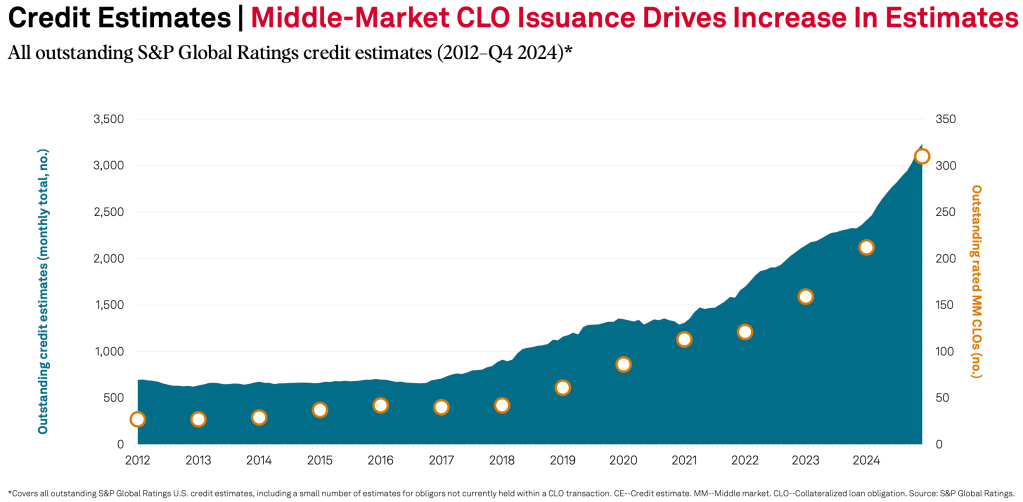

Source: S&P Global Ratings, Private Credit and Middle-Market CLO Quarterly – Q1 20251

Today, unitranche loans are thriving. According to recent data, unitranche volume has rebounded sharply in North America and is gaining ground in Europe, particularly for mid-cap buyouts and sponsor-to-sponsor deals.

- North America: According to LSEG LPC2, unitranche loan activity surged to $210 billion, up from $94 billion in 2023. Notably, large corporate unitranche volume grew to $154 billion.

- Europe: According to Deloitte3, for the 12-month period leading up to Q4 2024, 88% of the transactions are structured as a first lien structure (Senior/Unitranche/Stretched Senior/Super Senior RCF/Super Senior TL).

Why Sponsors Favor Unitranche in 2025

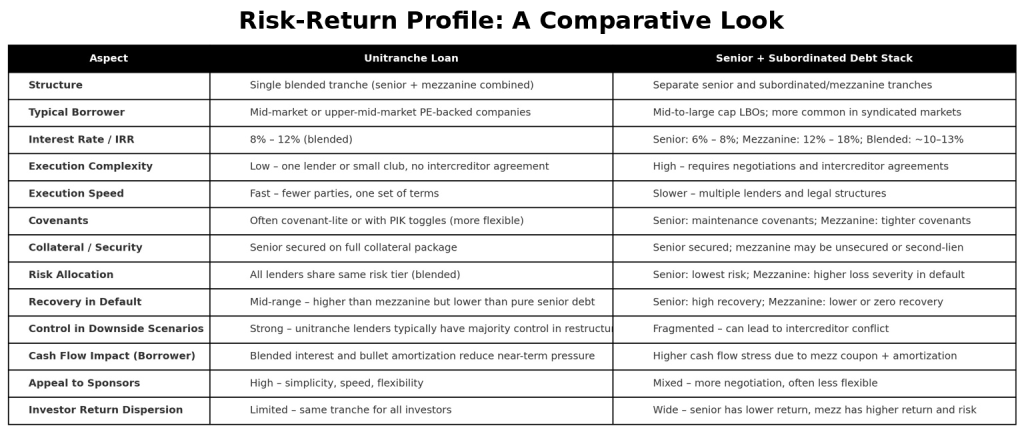

The renewed appeal of unitranche lies in its alignment with sponsor priorities in a risk-sensitive environment. Where traditional structures can introduce friction, through multiple creditor negotiations, intercreditor agreements, and syndication risk, unitranche delivers clarity.

Key advantages of unitranche loans over traditional senior/mezzanine debt structures:

- Simplicity & Execution Speed: Unitranche consolidate the senior and mezzanine tranches into a single facility (i.e fewer lenders involved) which speed up deal closing.

- Greater Flexibility and Custom Terms: Private credit lenders can tailor terms to match the unique cash flow profile, capex needs, or business model of a borrower.

- Higher Certainty of Funds: Direct lenders typically deploy their own capital, reducing execution risk.

- Better Control in Distressed Scenarios: Because the lender is often a single fund, they hold a cohesive control position if the company underperforms or needs restructuring

- Efficient Cash Flow Management for the Borrower: Unitranche often offers back-ended (bullet) repayment structures and fewer upfront fees, which allows companies to preserve liquidity in the early years of operation or post-acquisition transition

- Appealing to Mid-Market PE Sponsors: Preferred debt solution for deals between $50M–$500M.

The Lender’s Perspective

Underwriting a unitranche loan requires heightened credit scrutiny, as lenders assume the full risk spectrum without the protective cushion of a subordinated tranche. With no mezzanine buffer, lenders must have strong conviction in the borrower’s cash flow durability, sector fundamentals, and downside protections. This has led to a clear bifurcation in the market: high-quality sponsors and resilient businesses can secure unitranche financing on competitive terms, while weaker credits face materially higher pricing or may be excluded altogether.

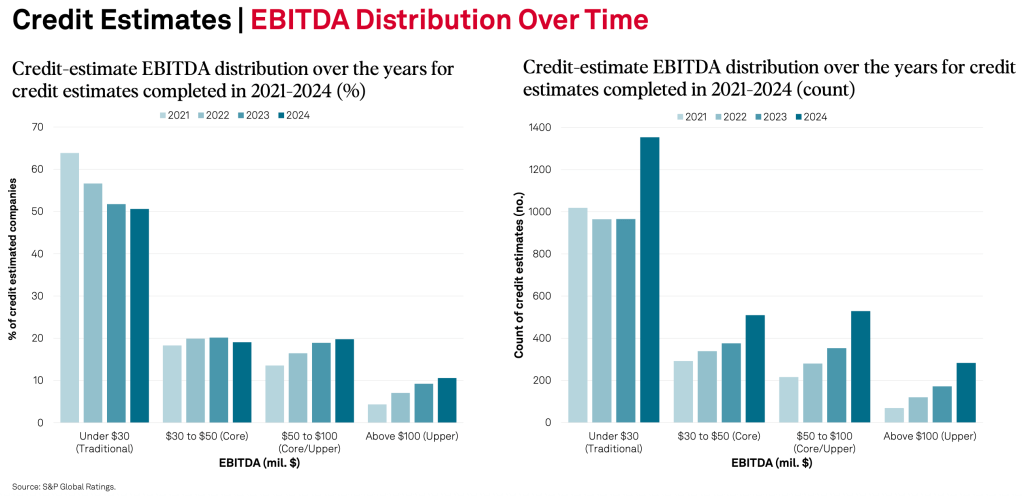

This bifurcation is visible in recent market data. As shown below, the share and volume of borrowers with $50–$100 million in EBITDA (typically the sweet spot for underwritten unitranche deals) has increased meaningfully in 2024. These borrowers are best positioned to benefit from flexible unitranche structures, while those with smaller EBITDA often face tighter terms or limited access.

Source: S&P Global Ratings, Private Credit and Middle-Market CLO Quarterly Q1 2025.

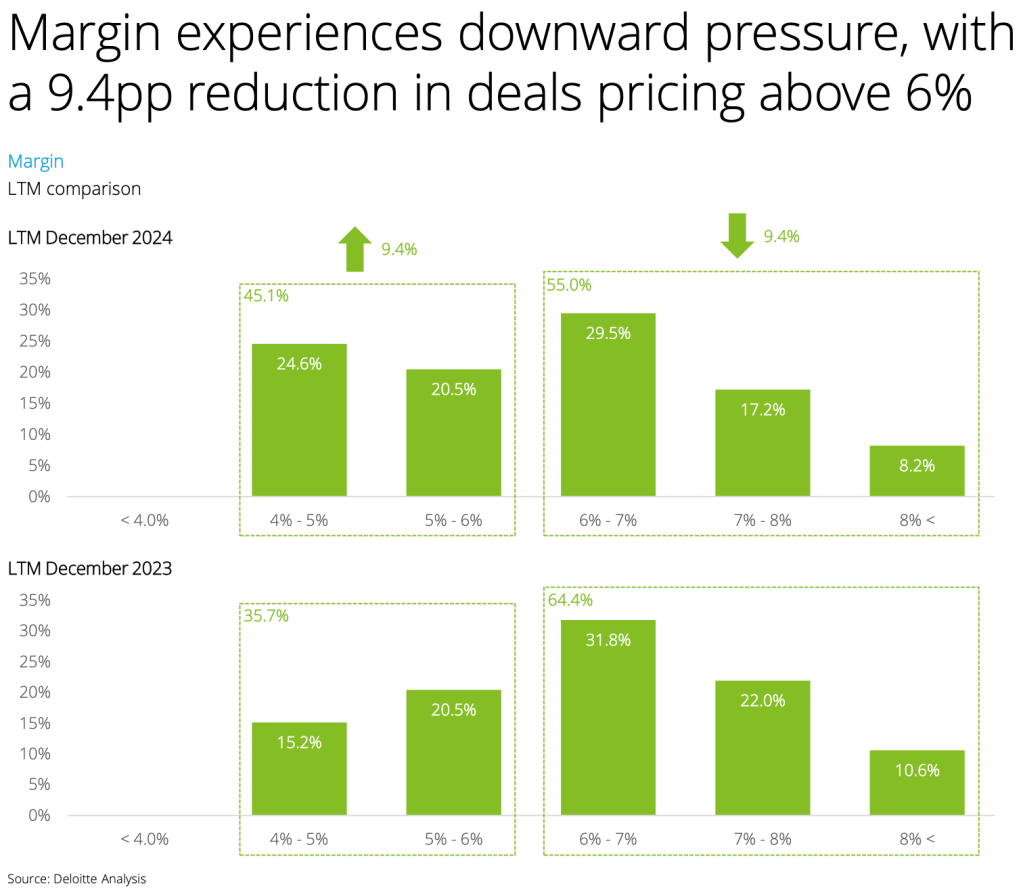

Unitranche financing has become a selective tool, rewarding creditworthy borrowers with speed and simplicity, while maintaining pricing discipline for weaker credits, as a result, private debt margins are compressing.The following chart illustrates a notable shift in private debt pricing dynamics between LTM December 2023 and LTM December 2024. Specifically, it shows a 9.4% reduction in the share of deals priced above 6%, with more transactions clustering in the 4%–6% range. Meaning, the decline in >6% pricing doesn’t mean riskier deals are getting cheaper, it means lenders are avoiding them, whereas the increase in sub-6% deals signals a flight to quality, where only resilient borrowers can access unitranche capital at scale. This supports this “selective tool” idea, capital flows to strong sponsors while riskier names are left behind or forced into higher-cost or structured solutions.

Source: Deloitte Private Debt Deal Tracker, Spring 2025

To highlight this concept, is notably to remark that this compression in margins is not a sign of loosening underwriting standards, it’s a function of selective capital deployment. As private credit funds compete for deals in a constrained lending environment, they are concentrating their firepower on borrowers who offer strong fundamentals, sponsor backing, and predictable cash flows. These credits are often able to command more favorable pricing, as lenders accept lower spreads in exchange for lower perceived risk.

Conversely, borrowers without these attributes, those with smaller EBITDA, sector volatility, or weak equity support, are either being priced at a premium or excluded altogether. These deals are not represented in the lower margin categories because they are not clearing at all under current market conditions.

A Function of Market Structure

The resurgence of unitranche financing is not simply a tactical trend, it is rooted in long-term shifts reshaping how leveraged credit is sourced, priced, and deployed.

- Bank Pullback: Regulatory Pressure and Risk Sensitivity:

- European and North American banks have continued to scale back their exposure to leveraged lending, driven largely by Basel III rules and rising capital requirements. These reforms have made holding and underwriting leveraged loans more capital intensive. At the same time, heightened scrutiny from internal credit committees and regulators has led to tighter credit standards, especially for non-investment grade borrowers and highly structured deals like LBOs.

- The consequence is a shrinking willingness among banks to underwrite aggressive leverage or to warehouse risk for syndication. This retrenchment has opened the door for direct lenders and private credit funds to fill the gap.

- Private Credit Expansion: Institutional Capital Fuels Alternative Lending

- Private credit has rapidly matured from a niche asset class into a mainstream portfolio allocation for institutional investors. Pension funds, insurance companies, endowments, and sovereign wealth funds have channeled billions into direct lending strategies in search of yield, duration, and low correlation with public markets.

- This influx of capital has enabled private debt managers to scale up and underwrite larger, more complex loans. These funds are not constrained by regulatory risk-weighted capital charges like banks, allowing them to be more commercial and flexible in their approach to structuring deals. As a result, unitranche loans have evolved from a middle-market product to a viable replacement for syndicated financing in an expanding range of transactions.

- Volatility Aversion: Certainty Over Price Volatility

- Since 2022, the leveraged finance markets have remained increasingly unpredictable. Public credit spreads have widened, investor risk appetite is episodic, and secondary trading has been volatile. This has created a syndication risk premium: even if a bank underwrites a loan, the final pricing and execution may shift before closing, undermining deal certainty.

- In 2025, public markets remain volatile. Syndicated loan spreads have widened, and investor appetite is selective. Sponsors are prioritizing deal certainty over marginal pricing improvements.

Limitations and Strategic Considerations of Unitranche Financing

While unitranche structures offer significant advantages in terms of simplicity, execution speed, and flexibility, as mentioned above, they are not universally optimal.

- Capacity Constraints in Large-Scale Transactions

- For large LBOs or infrastructure assets, syndicated loan markets and public debt markets offer greater liquidity, broader investor bases, and pricing efficiency at scale. Unitranche lenders may be reluctant to underwrite large deals on balance sheet, or they may form large club deals, which can reintroduce intercreditor complexities.

- Strategic Use of Layered Debt:

- The granularity and customization of traditional senior/mezzanine financing can provide superior alignment with the sponsor’s capital strategy.

- Exit Strategy Challenges:

- The lack of clear structural subordination in a unitranche loan may be viewed unfavorably by institutional investors or rating agencies when the capital structure is later repackaged or syndicated. This could lead to wider spreads, weaker demand, or complex refinancing negotiations if the market demands clearer priority ranking among creditors.

- Relative Cost in Stable Credit Markets:

- In bull market conditions, sponsors may find that a senior + mezzanine structure is cheaper on a blended basis, especially when mezzanine lenders accept equity kickers or if senior debt pricing tightens due to competitive dynamics.

Conclusion: Simplicity in Complexity

In today’s volatile financial landscape, unitranche financing has re-emerge as a tool for private equity sponsors, particularly in mid-market transactions. Its resurgence is driven by the need for speed, certainty, and flexibility, qualities that traditional multi-layered debt structures often lack. By consolidating senior and subordinated debt into a single tranche, unitranche loans simplify negotiations and expedite deal closures, making them especially attractive for deals ranging from $50 million to $500 million.

However, unitranche has its limitations. The structure may pose challenges in large-scale transactions, where syndicated markets offer greater capacity and flexibility. Additionally, the lack of clear subordination in unitranche loans can complicate refinancing efforts or public market exits.

In summary, while unitranche financing is not a universal solution, its advantages align well with the current demands of private equity sponsors seeking efficient and reliable funding mechanisms in uncertain times.

Daniel Rivas

Leave a comment