For decades, the Japanese yen (JPY) has held a unique position in global financial markets, not because of its strength, but because of its weakness. Japan’s persistently low interest rates and deflationary conditions made the yen the ideal funding currency for the global carry trade. Investors borrowed JPY at ultra-low cost and invested the proceeds in higher-yielding assets, profiting from the interest rate differential. But as 2025 unfolds, this familiar strategy faces a serious test.

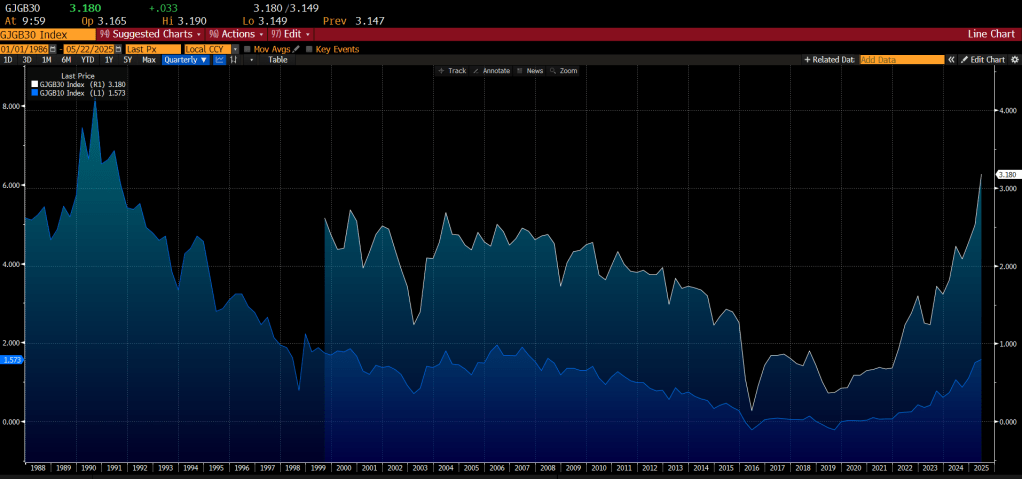

The Bank of Japan (BoJ), after more than two decades of dovish monetary policy, has finally shifted gears. In early 2025, it raised its short-term policy rate to 0.5%, and more notably, allowed long-term yields to rise more freely. As of May, the 10-year Japanese Government Bond (JGB) yield sits around 1.5%, while the 30-year yield is approaching 3%, levels not seen since the early 2000s.

This sharp upward move in yields has profound implications. It challenges the long-standing assumptions behind the yen carry trade and forces investors to rethink whether JPY can still serve as a reliable funding for global investments.

The Mechanics Behind the Carry Trade

At its core, a carry trade exploits differences in interest rates between two countries. Investors borrow in a low-yielding currency (like the yen) and invest in higher-yielding currencies (like the Brazilian real or Indian rupee). The profit comes from the interest rate differential, sometimes amplified by favorable currency movements or leverage.

The yen’s appeal in this context has been clear: low cost, low volatility, and predictability. As long as the BoJ kept policy steady, funding in yen was cheap and reliable, especially in a world where other central banks were tightening aggressively.

Real-case Carry Trade Strategy Simulation: LONG basket high-beta emerging market currencies + SHORT JPY

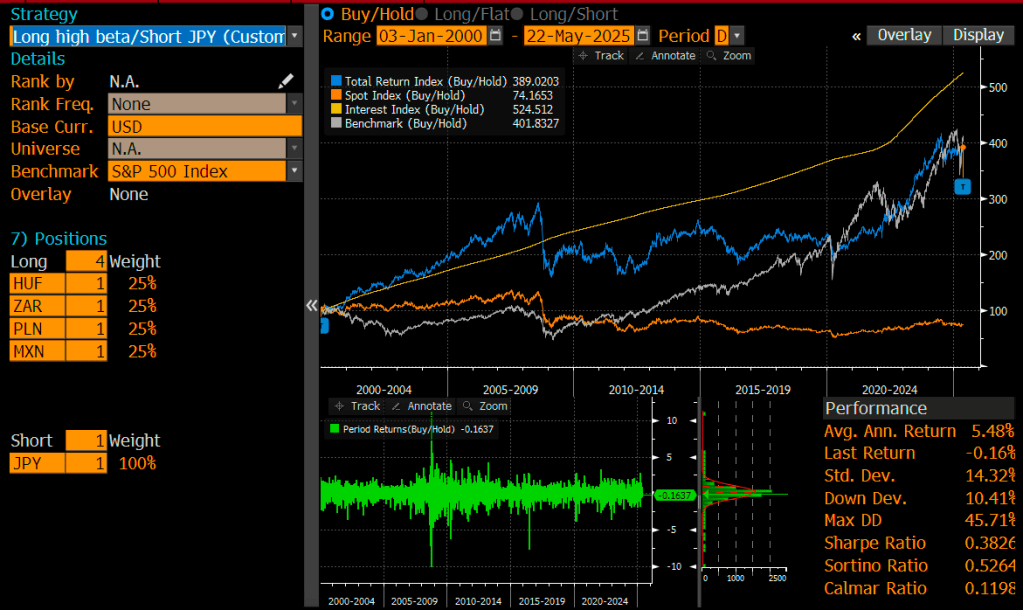

To better understand the structural dynamics of yen-funded carry trades, it’s instructive to analyze a historical simulation of a strategy that goes long a basket of high-beta emerging market currencies (simulation run on the Bloomberg Terminal as of 22/05/2025): the Hungarian forint (HUF), South African rand (ZAR), Polish zloty (PLN), and Mexican peso (MXN), equally weighted at 25%, and short the Japanese yen (JPY) as a funding leg. This setup represents a classic FX carry portfolio, where investors earn a yield spread between higher interest rate currencies and a low-yielding funding currency.

The chart from Bloomberg presents three performance indices over the 25-year period from January 3, 2000 to May 22, 2025:

- Total Return Index (Blue line): This captures the full return of the strategy, combining interest earned from the yield differential (carry) and gains/losses from FX spot movements. Over the full period, this strategy delivered a cumulative return of 389%, closely rivaling the S&P 500 benchmark, which returned 402% over the same horizon.

- Interest Index (Orange line): This isolates the carry component, showing the return an investor would have earned solely from the interest rate differentials between the long and short currencies, assuming FX spot rates remained unchanged. It is this orange line, returning 524.5%, that demonstrates the enduring power of carry when rate differentials are wide and stable. Notably, this outpaced the equity benchmark, revealing that yield harvesting alone has been highly profitable over time.

- Spot Index (Gray line): This reflects gains and losses from FX spot movements only, excluding any carry. The spot component delivered just 74% over the same period, highlighting a key vulnerability: yen appreciation or EM currency depreciation during global risk-off events, such as the 2008 financial crisis, COVID shock in 2020, or geopolitical-driven volatility, can offset or even reverse the gains from carry.

Below the main chart, the periodic return histogram (green bars) shows the return distribution over time. It reveals long stretches of steady, positive monthly returns, typical of carry strategies, punctuated by sharp drawdowns during episodes of heightened market stress. The most significant drops, evident around 2008 and 2020, reflect forced unwinds of carry positions as investors fled risky EM currencies and rushed into safe-haven assets like the yen.

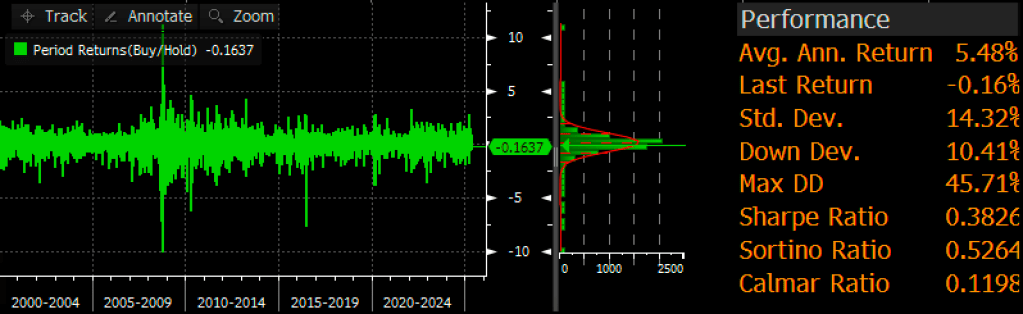

The performance metrics panel on the right quantifies the strategy’s risk-adjusted return characteristics:

- Average Annual Return: 5.48%: For comparison, the benchmark (SP500) average annual return for the same period was 6.87%.

- Standard Deviation: 14.32%: reflecting the volatility of unhedged FX exposure.

- Max Drawdown: 45.7%: highlighting vulnerability during liquidity shocks.

- Sharpe Ratio: 0.38 and Sortino Ratio: 0.53: suggest moderate-to-low risk-adjusted efficiency.

- Calmar Ratio: 0.12: indicating limited return per unit of drawdown risk.

What’s Changing in 2025

The first issue facing carry traders is rising funding costs. As yields on Japanese bonds rise, the cost to borrow yen, directly or synthetically via FX swaps, increases. This eats into the net returns of the carry trade. When the 10-year yield was under 0.3%, a 5-6% on EM or high-yield debt looked attractive. With JGB yields near 1.5% and climbing, that same spread narrows significantly.

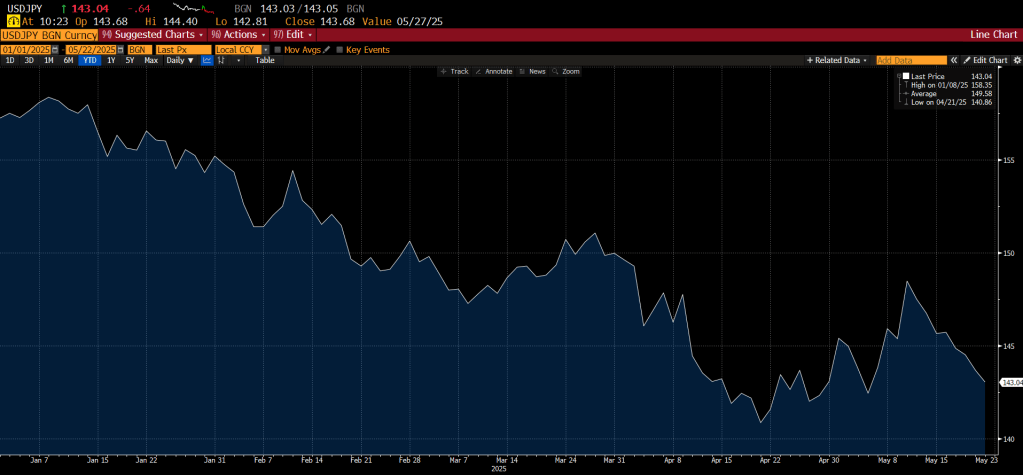

Second, there’s the issue of currency risk. As the BoJ steps away from yield curve control and reduces its presence in bond markets, the yen has started to appreciate. In fact, JPY is up 4% YTD against the dollar, fueled by expectations of further rate hikes and its safe-haven status in a volatile global environment. A strengthening yen hurts carry trades: even if the yield differential remains favorable, any FX losses can more than offset the gains.

Third, volatility. For years, Japan was a low-volatility environment (i. e stable rates, a steady currency, and a central bank that rarely surprised markets). But that regime is breaking down, BoJ policy is now more responsive to inflation and external pressures. That uncertainty makes the yen a less predictable funding currency.

But It’s Not the End, It´s Just a Shift

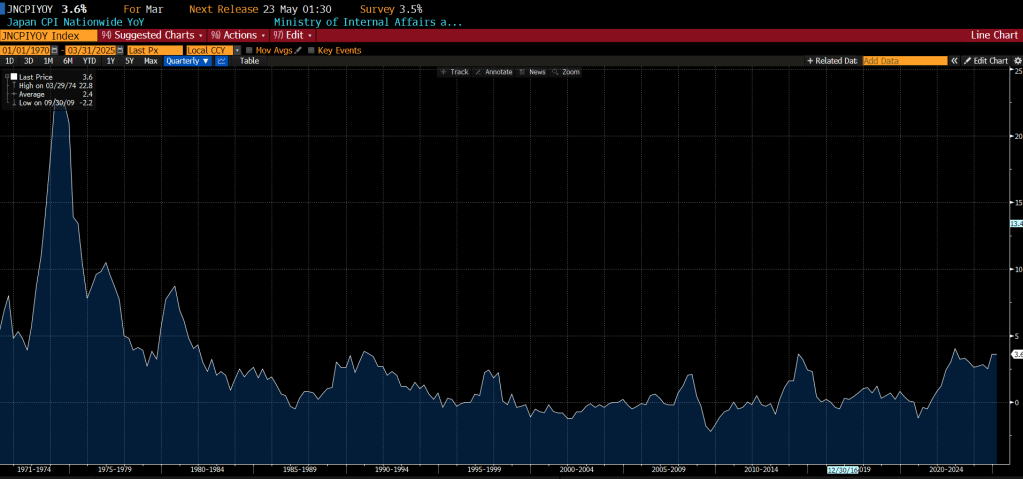

Despite these headwinds, calling for the death of the yen carry trade would be premature. Japan’s real interest rates (i. e interest rates adjusted for inflation) remain deeply negative. Inflation in Japan is running around 3.6%, meaning that even with the nominal policy rate at 0.5%, real yields are still significantly below zero. From this perspective, the yen remains “cheap money.”

Moreover, as other central banks, especially the Federal Reserve, approach the peak of their tightening cycles, the interest rate gap could begin to widen again. If the Fed cuts rates while the BoJ holds steady, carry trade differentials may remain viable.

Additionally, many institutional investors use sophisticated tools such as interest rate swaps and currency forwards to manage exposure. For them, the JPY carry trade can be retooled rather than abandoned. They may shift to shorter durations, hedged positions, or tactical allocations based on volatility regimes and macro shifts.

How the JPY Carry Trade Works in Practice

The JPY carry trade isn’t just a theoretical concept, it’s actively implemented across a range of institutional strategies using specific financial instruments. While the basic premise remains simple, borrow in yen, invest in higher-yielding assets, the execution can vary widely depending on investor type and risk appetite.

- Spot FX + Interest-Bearing Asset: Investors borrow or short yen, convert proceeds into a higher-yielding currency (e.g., BRL, ZAR, or INR), and allocate into local bonds or deposits.

- FX Swaps and Forwards: Simultaneously buy a high-yielding currency spot and sell it forward against JPY. The implied yield differential (via forward points) reflects the carry.

- Cross-Currency Basis Swaps: Exchange notional and interest payments in JPY vs another currency (floating vs floating or fixed vs floating). Adjusted for basis spread that reflects demand for one currency’s funding.

- FX Futures or Options: Long futures on high-yield FX vs short JPY futures or long a call on a high-yield FX / put on JPY.

Conclusion

The days of the yen being a “free money” engine for carry trades could be seen as over. Rising yields, a stronger currency, and policy uncertainty have eroded the comfort zone for JPY-funded strategies. But they have not eliminated the appeal entirely.

Rather than abandon the yen carry trade, investors are likely to adapt, approaching it as a tactical, duration-sensitive strategy rather than a structural bet. This is because the yen still holds structural appeal: deeply negative real rates, a high level of market liquidity, and Japan’s enduring status as a safe-haven economy. Investors who can actively manage duration, hedge FX exposures, and interpret shifting policy signals, it remains a valuable, if more complex, tool in the global macro arsenal.

Daniel Rivas

Leave a comment