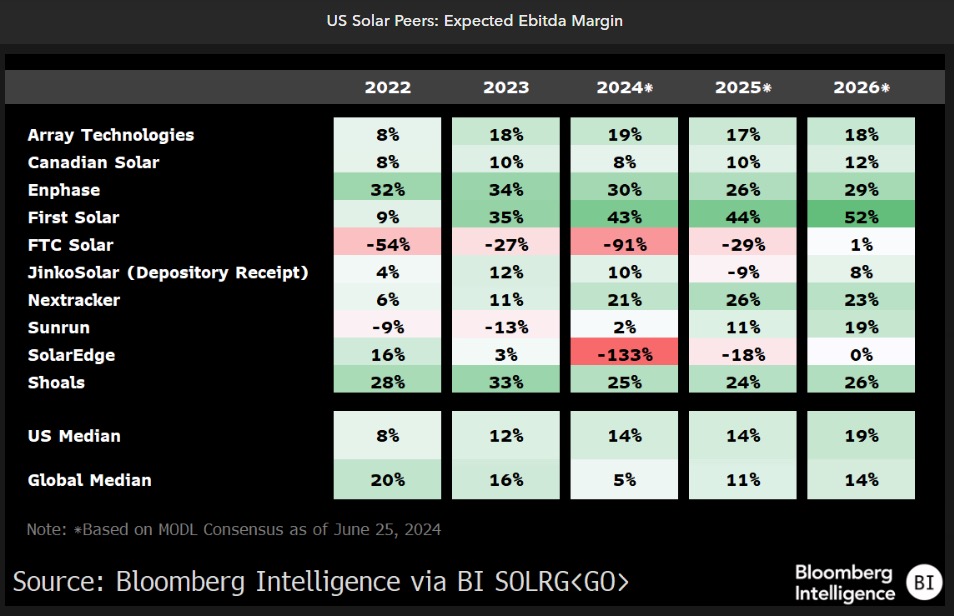

The U.S. solar sector is about to enter a new era of profitability that could lead to double-digit EBITDA margins while many global peers still struggle in the mid-single digits.

First Solar, Enphase and Nextracker are forecasted to climb to 29-52 % EBITDA margins by 2026, against a projected global‐sector median of just 14 %, due to four reinforcing tailwinds; Inflation Reduction Act (IRA) incentives, tariff protection, falling input costs and a surge in demand.

Company-by-Company Outlook

First Solar

First Solar is a leading U.S.-based solar panel manufacturer specializing in thin-film photovoltaic (PV) technology. Unlike traditional silicon-based panels, its cadmium telluride (CdTe) modules offer high performance under extreme conditions and lower carbon intensity. The company is vertically integrated, with a strong U.S. manufacturing footprint and a significant contracted backlog through 2027. It plays a central role in utility-scale solar deployments and benefits heavily from IRA-driven domestic incentives.

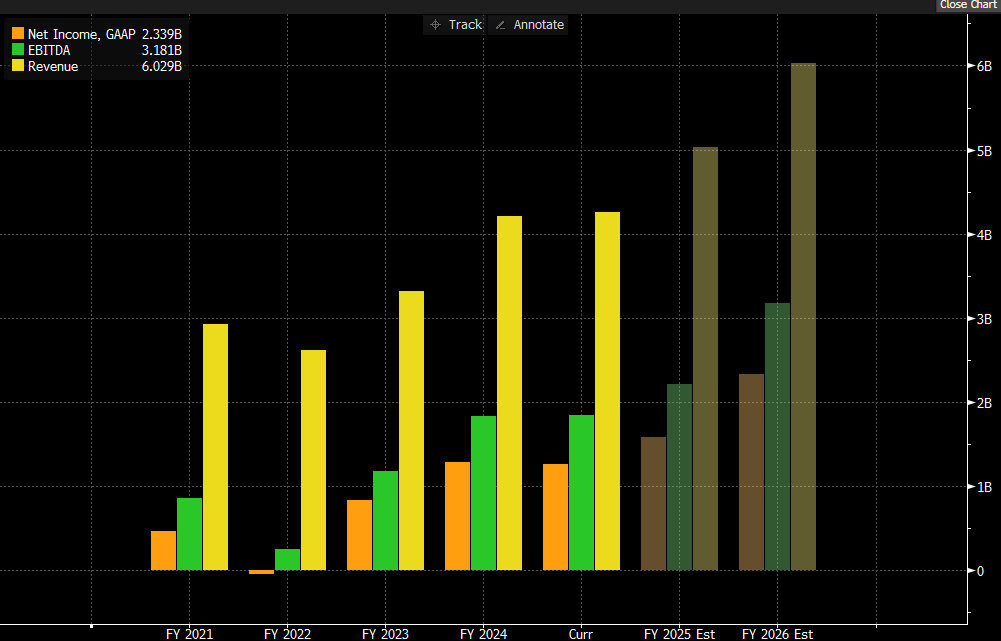

First Solar stands out as the clear frontrunner in the margin race. According to its financial data, the company’s EBITDA margin is expected to reach 44% in 2025 and potentially surpassing 52% in 2026. This performance is extraordinary in a global context, where the median EBITDA margin for solar module manufacturers is expected to stay at 11% in 2025 and 14% in 2026.

First Solar´s financial turnaround is evident in its recent results. The company shifted from a net loss in 2022 to a net profit of $830M in 2023, as higher module prices and volumes drove revenues up by $700M YoY. In 2024, revenue reached $4,2B, with projections for 2025 and 2026 between $5,3B – $6B. The company´s backlog and capacity expansions in Alabama, Ohio, Louisiana and India support its ambitious growth trajectory.

Enphase

Enphase is a global leader in solar microinverter systems, battery storage, and smart energy management solutions. Its technology allows for module-level power optimization and real-time performance monitoring. Enphase plays a key role in the residential and commercial solar markets, particularly in the U.S. and Europe, and has scaled its U.S. manufacturing to benefit from IRA-linked domestic content bonuses.

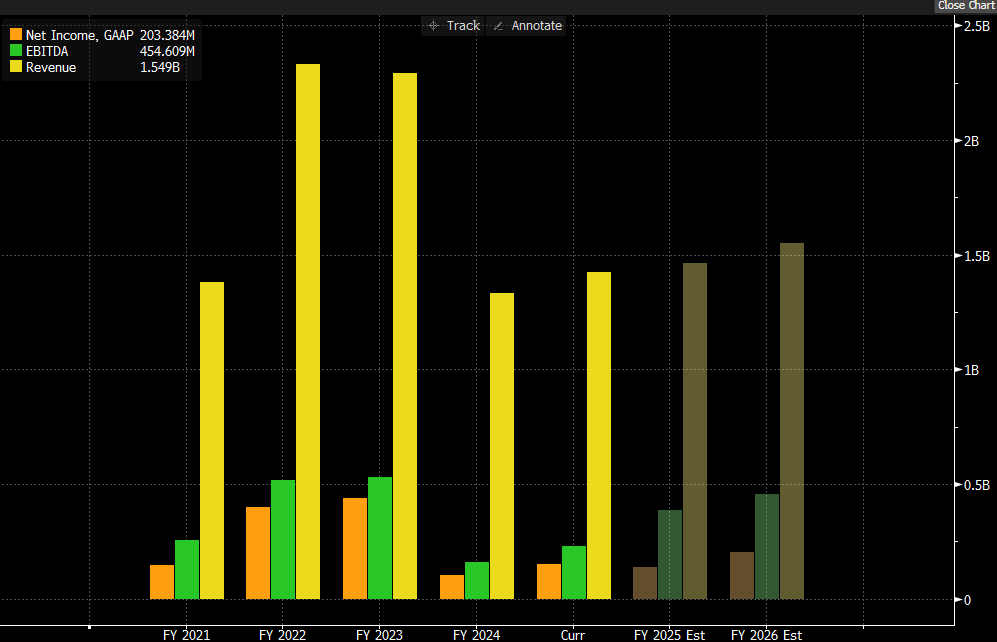

Enphase Energy has historically been a margin leader, but its EBITDA margin has moderated recently. After peaking at 32% in 2022, Enphase’s margin is expected to be 26% in 2025 and 29% in 2026.

The micro-inverter pioneer has shifted a portion of manufacturing to Columbia, South Carolina and Salcomp facilities in Texas and Wisconsin. Its business, mainly focused on micro-inverters and home energy solutions, remains highly profitable, nevertheless, the company faces margin pressure from sector´s competition, price volatility and global supply chain disruptions. The company´s net income increased 10% between 2022 and 2023, from $397M to $438M, but during 2024 declined 72% to $102.7M. Revenue reached $2,3B in 2023 but declined to $1,3B in 2024.

Nextracker

Nextracker is a top provider of solar tracker systems that maximize energy yield by following the sun’s movement throughout the day. A spin-off from Flex Ltd., it serves utility-scale solar developers globally and is the market leader in single-axis trackers. Its U.S.-based production and modular design make it a preferred choice for large solar farms seeking higher efficiency and IRA-aligned components.

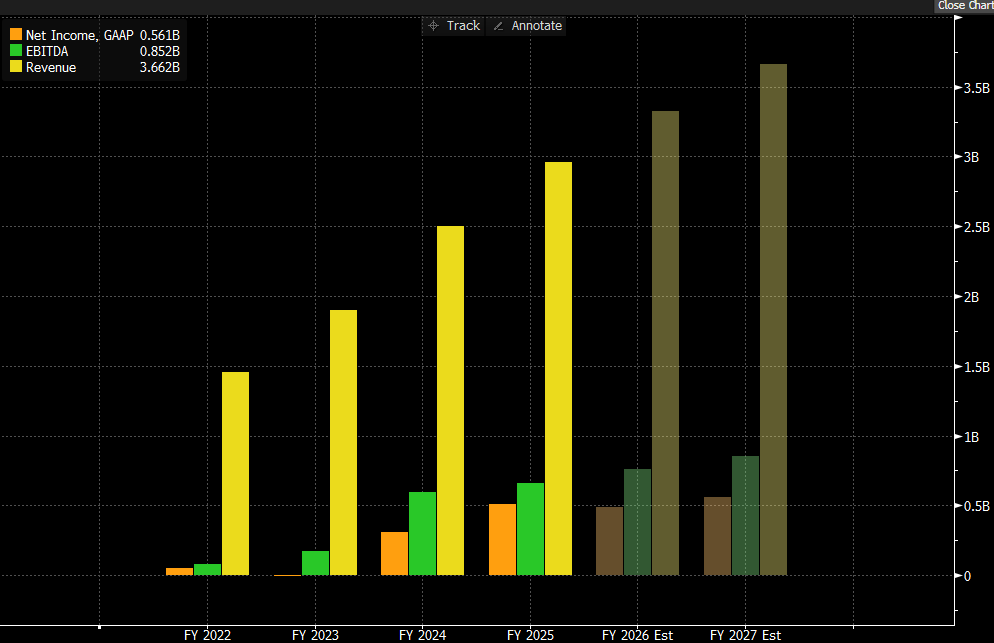

This provider of solar tracker and software solutions has emerged as a major margin contender. The company’s EBITDA margin has increased sharply, from 5,41% in 2022 to 23,75% in 2024. In Q1 FY25, Nextracker reported an adjusted EBITDA margin of 24%, reflecting robust demand and operational leverage.

The company´s net income increased 26,692% between 2023 and 2024, from $1,1M to $306M, and kept rising during the first quarter of 2025 to $509M.

Key drivers of growth and potential risks

The U.S. solar sector is gaining strong momentum due to four reinforcing factors:

Inflation Reduction Act (IRA) extends key tax credits like the ITC and PTC, adds a 25% manufacturing credit, and allows credit transferability, boosting margins and investment certainty, especially for U.S. manufacturers like First Solar and Enphase.

- Key risk: IRA roll-backs: although no major policy changes are expected before the 2026 congressional cycle, a shift could erase margins

Tariffs and trade rulings protect domestic producers from low-cost imports, allowing companies like First Solar (exempt from tariffs) to secure long-term, high-margin contracts, while Nextracker benefits from increased demand for local tracker systems.

- Key risk:Chinese excess capacity could slash global module ASPs; even with tariffs, U.S. spot pricing would come under pressure.

Polysilicon prices have collapsed from $40/kg to below $7/kg, easing input costs across the supply chain; Enphase, for instance, has improved its margin outlook due to normalized component pricing.

- Key risk:Polysilicon price rebounds or inverter chip shortages could resurrect 2022‐style cost spikes.

Surge in solar demand: from 32 GWdc in 2023 to over 48 GWdc by 2026, driven by utility-scale growth and resilient residential markets, supports long-term sales visibility. First Solar has already contracted over 90% of its expected production through 2026, de-risking its revenue base and reinforcing its margin leadership.

- Key risk:Bottlenecks and high interest rates may delay utility-scale projects, lowering module demand in 2025-26.

Conclusion

First Solar’s unique technology, locked-in backlog and IRA-fueled manufacturing credits give it a credible path to >45 % EBITDA margins in 2025 and above 50 % by 2026, setting a new profitability benchmark for global solar manufacturing. Enphase and Nextracker follow closely, each leveraging domestic production and technology leadership to defend high-20s margins. The broader U.S. peer group is poised to lift its median EBITDA margin from 8 % in 2022 to 19 % by 2026, widening the gap with global manufacturers. Barring a dramatic policy reversal or cost shock, America’s solar tops are on track to convert industrial policy into world-leading returns, redefining the value proposition of renewable energy manufacturing in the process.

Daniel Rivas

Leave a comment