As global energy dynamics continue to evolve, the oilfield services sector remains a cornerstone of upstream operations, spanning drilling, completion, and production services. For investors and industry analysts, understanding how different subsectors are valued offers critical insights into capital flows, risk pricing and strategic opportunities.

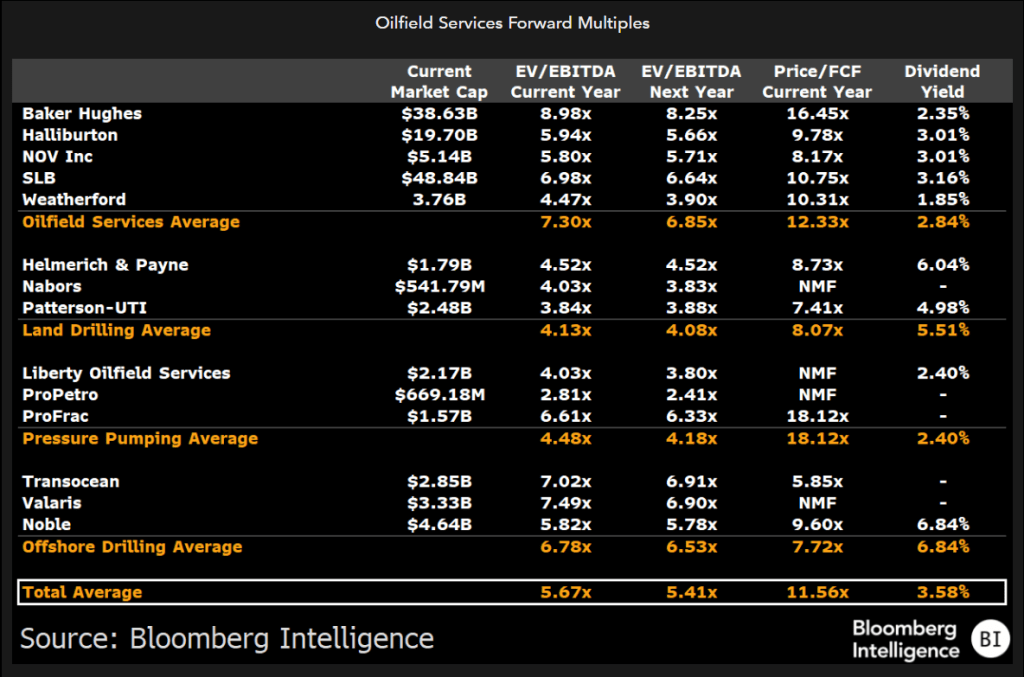

A recent snapshot from Bloomberg Intelligence provides a comprehensive comparison of forward valuation multiples across four key subsectors: Oilfield Services, Land Drilling, Pressure Pumping, and Offshore Drilling.

Oilfield Services

The largest players by market capitalization, SLB, Baker Hughes, and Halliburton, dominate the traditional oilfield services space. SLB alone holds a $48.84 billion market cap, more than all the listed land drillers and pressure pumpers combined.

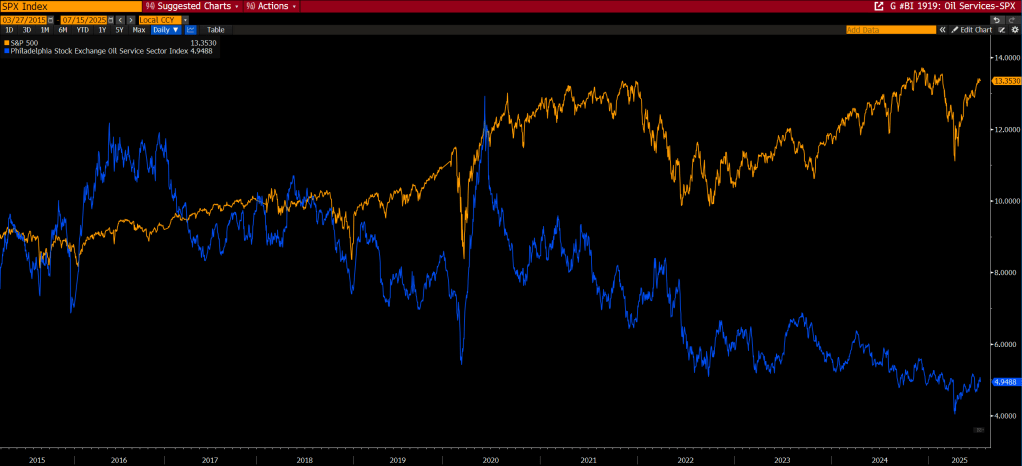

These companies lead higher EV/EBITDA multiples, with a group average of 7.30x for the current year and 6.85x for next year, which reflects investor confidence in their global scale, technology leadership, and integrated service offerings. Nevertheless, even investors identifying SLB and Baker Hughes as “best-in-classs” oil services firms, they still belong to a sector that has massively underperformed, as can be seen when comparing Forward EV/EBITDA between the S&P 500 Index (orange line) with the Philadelphia Oil Services Sector Index (blue line) over a 10-year period (2015–2025).

Price to Free Cash Flow (P/FCF) averages 12.33x, a relatively fair valuation given their strong cash conversion and dividend payout capacity. With an average dividend yield of 2.84%, these firms are also appealing to income-seeking investors.

Land Drilling

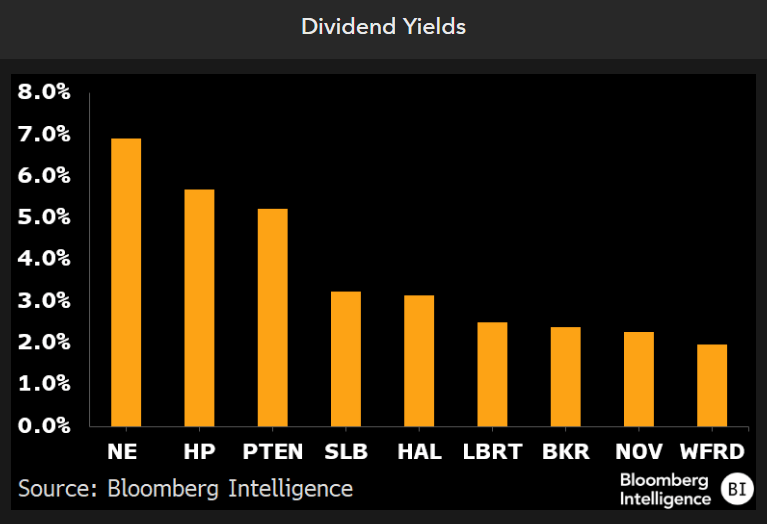

The EV/EBITDA multiples for Helmerich & Payne, Nabors, and Patterson-UTI are markedly lower than the broader oilfield services group, averaging just 4.13x for the current year and 4.08x for next year. Despite these low valuations, the group delivers a relatively attractive average Price/FCF of 8.07x and a standout dividend yield of 5.51%, led by Helmerich & Payne (6.04%) and Patterson-UTI (4.98%).

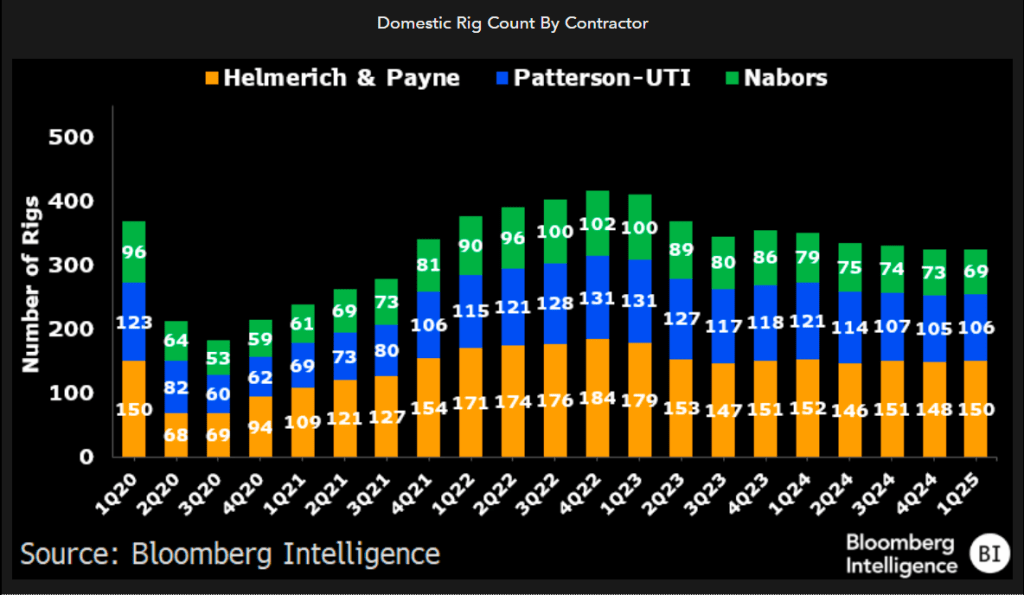

As shown in the chart below, land rig utilization peaked in early 2023 and has since moderated, but H&P maintains a clear lead in rig count. While overall activity has declined from the post-COVID recovery peak, rig deployment has remained stable for key players, suggesting a floor for operational resilience even amid commodity price swings.

Pressure Pumping

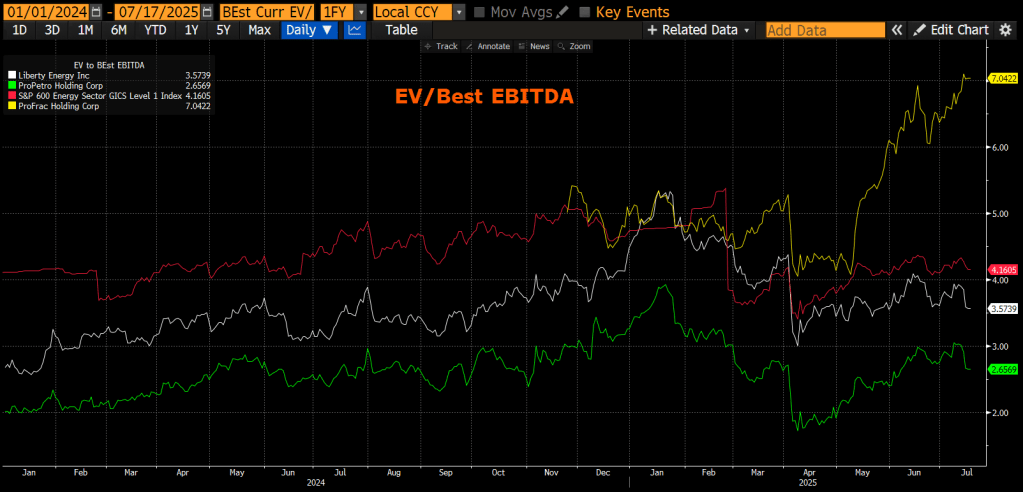

The pressure pumping segment, featuring Liberty Oilfield Services, ProPetro, and ProFrac, presents an unusual valuation mix. EV/EBITDA averages are modest at 4.48x (current year) and 4.18x (next year), among the lowest in the dataset.

However, Price/FCF is highly skewed due to ProFrac’s high multiple of 18.12x, while both Liberty and ProPetro do not have FCF data available (NMF – Not Meaningful Figure). The segment’s average dividend yield stands at 2.40%, though only Liberty reports a payout.

According to Bloomberg Intelligence analysis, pressure pumping activity is expected to decline significantly in 2025, with earnings potentially dropping by over 30% as lower oil prices force producers to slow down well completions. For 2025, Bloomberg forecasts EBITDA for pressure pumping names such as Liberty, ProFrac, and Patterson-UTI to fall 32% year-over-year, and come in roughly 7% below market expectations. This projection is based on a 22% decline in average active fleets and a 2% decrease in realized pricing, leading to an implied annualized EBITDA of $15 million per spread, consistent with historical mid-cycle levels.

Offshore Drilling

Perhaps the most compelling data comes from the offshore drilling group: Transocean, Valaris, and Noble. The group shows a current EV/EBITDA average of 6.78x, slightly below the oilfield services majors but above land and pressure pumping peers.

Importantly, this group delivers the highest average dividend yield at 6.84%, driven exclusively by Noble’s payout. The Price/FCF multiple of 7.72x suggests strong relative value given the improving cash generation in the offshore segment.

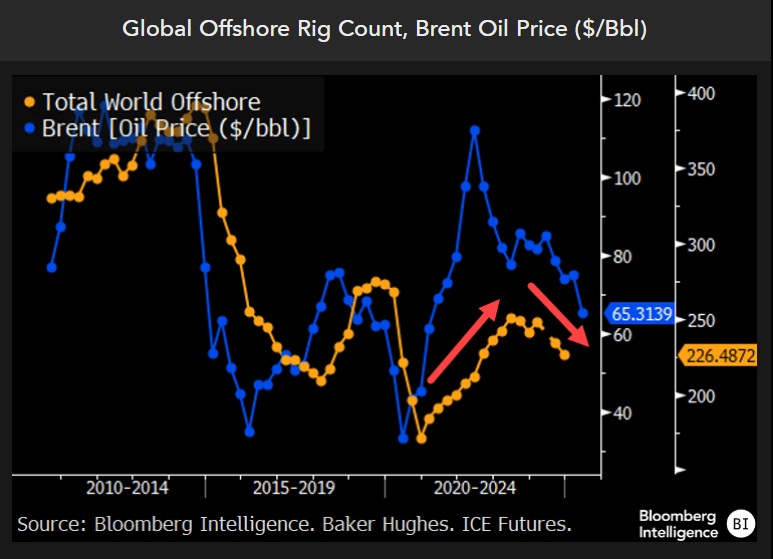

While Brent crude has declined sharply from its 2022 highs, offshore drilling activity has proven more resilient. With global offshore rig counts still above pre-COVID levels, the sector shows signs of stability, backed by multi-year contracts and a shift toward more economically viable deepwater developments.”

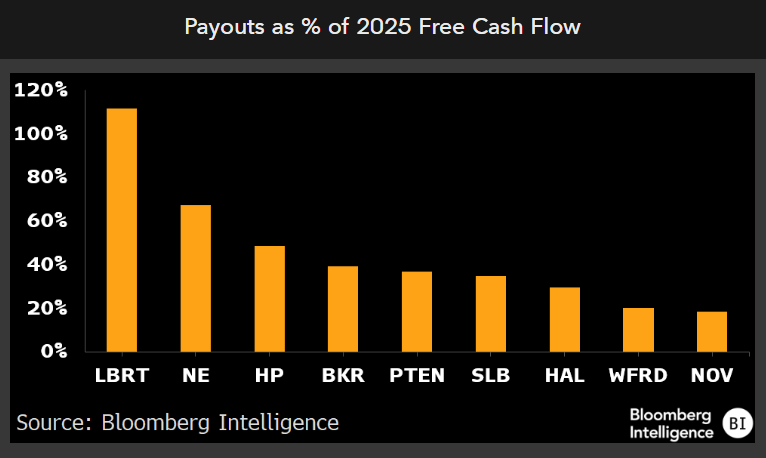

Capital Return Analysis

Capital return strategies vary widely across oilfield services firms, with some prioritizing high payouts while others focus on reinvestment and balance sheet strength. Liberty stands out with a payout exceeding 100% of projected 2025 free cash flow, while Noble and Helmerich & Payne offer elevated dividend yields of 7% and 5.7%, respectively, signaling strong shareholder focus. In contrast, SLB, Halliburton, and NOV maintain lower payout ratios and yields, reflecting a more conservative or growth-oriented approach. Dividend trends show that while companies like SLB and HP offer steady increases, others such as Noble have demonstrated volatility, underlining the strategic divergence between income-led and reinvestment-led models.

Conclusion

The oilfield services sector presents a diverse and evolving investment landscape marked by significant variation across subsectors such as Land Drilling, Offshore Drilling, and Pressure Pumping. While traditional giants like SLB and Baker Hughes command premium valuations, segments like Land and Offshore Drilling offer compelling relative value through attractive Price/FCF multiples and higher dividend yields. As of July 2025, forward multiples reveal cautious optimism fueled by M&A activity, technological advancements, and rising operator spending. However, the sector remains exposed to risks tied to oil price volatility and geopolitical uncertainty. Successful investment requires a nuanced understanding of subsector-specific capital allocation strategies, disciplined execution, and the ability to adapt to a shifting energy landscape. Companies that effectively integrate digital innovation and prioritize efficient capital management are best positioned for long-term outperformance.

Daniel Rivas

Leave a comment