In early 2025, the US Treasury market was shaken by a sharp and unexpected spike in volatility. At the center of the disruption was a geopolitical catalyst: the US administration’s aggressive imposition of new tariffs, which sent shockwaves through global markets. Beyond the surface-level policy moves, a deeper structural force turned a sell-off into a significant market disruption, the unwinding of leveraged hedge fund basis trades.

Although the tariffs themselves triggered the initial sell-off in government bonds, it was the mass liquidation of these basis trades, considered a relatively low-risk arbitrage strategy, that significantly amplified the market’s reaction. As 10-year Treasury yields surged above 4.5%, hedge funds faced a margin-driven challenge. The consequence was a cascade of selling and a rapid tightening of liquidity, pouring fuel on the fire in an already turbulent and volatile environment.

Understanding the Basis Trade

A Treasury basis trade is a type of arbitrage strategy that seeks to profit from the price difference between cash Treasuries and Treasury futures. In practice, hedge funds typically go long the cash Treasury bond and short the corresponding futures contract. The trade is often leveraged many times over using repo financing to enhance returns, relying on the assumption that the price relationship between the two instruments will converge over time.

Under normal market conditions, the basis trade is considered relatively safe. The spread between cash and futures prices tends to be small and stable, and the trade generates modest, predictable profits, especially attractive in a low-volatility, low-yield environment. But the key vulnerability lies in the leverage. When markets move rapidly, even small price dislocations can trigger significant losses and forced deleveraging.

The 2025 April Shock: When the Tariffs Hit

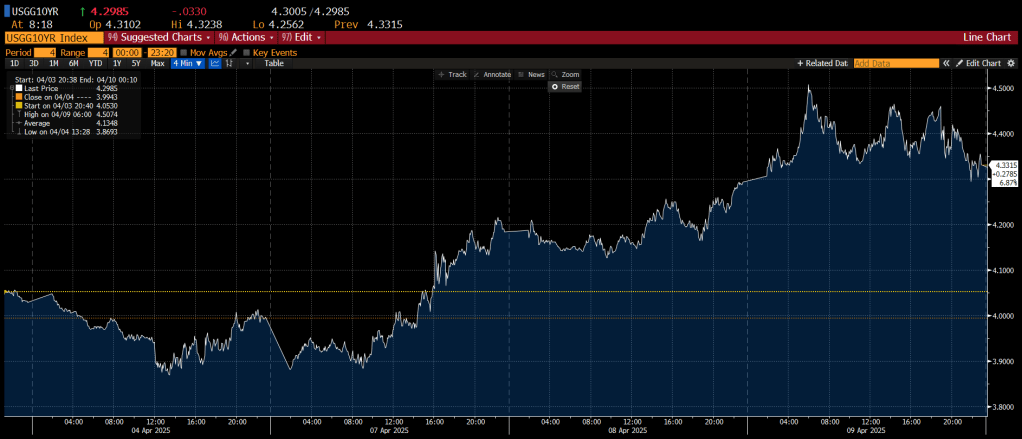

The volatility that shook the Treasury market in April 2025 began with the announcement of extensive US tariffs on imports from several major trading partners. The move frightened investors, who feared a comeback of inflation and a potential escalation into a global trade conflict. As a result, Treasury yields spiked sharply, with the 10-year note climbing past 4.5% in a matter of days, as shown in the chart below.

Bloomberg Terminal. USGG10YR Index (10-Year U.S. Treasury Yield) Period: 04.04.2025 – 09.04.2025

This abrupt shift in yields placed enormous stress on hedge funds running basis trades. As bond prices dropped and futures contracts diverged, the a priori stable arbitrage relationship broke down. Funds that had been borrowing heavily to finance their positions suddenly faced escalating margin calls. To meet them, they began liquidating their holdings, not gradually, but rapidly.

Unwinding and Amplification

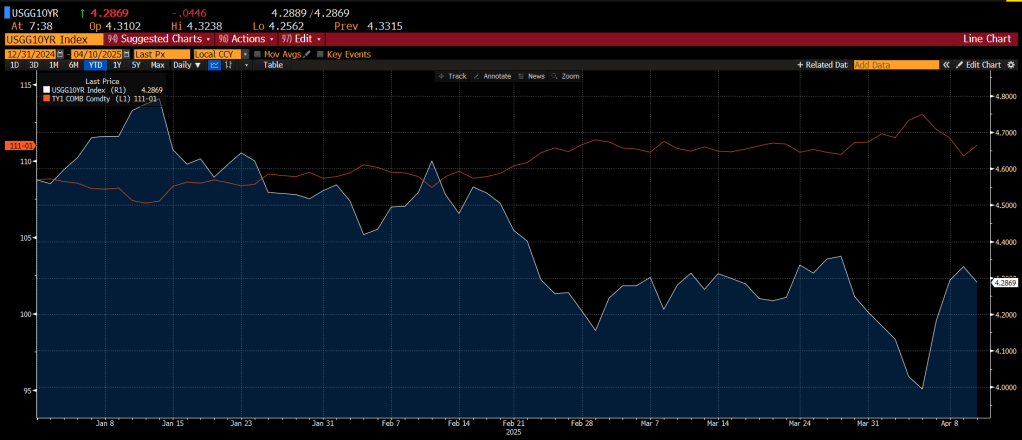

The forced unwinding of basis trades unleashed a second wave of volatility. As hedge funds sold off cash Treasuries to meet margin calls, they flooded the market with supply, further driving down prices and pushing yields even higher. Meanwhile, the futures side of the trade became disconnected, leading to a widening of the basis and further exacerbating losses for remaining participants. This dislocation, visible in the divergence between the 10-year U.S. Treasury yield (USGG10YR Index) and 10-Year Treasury Note Futures (TY1 Comdty) as shown in the next graph, led to significant losses for hedge funds engaged in leveraged arbitrage trades, contributing to a broader spike in market volatility.

Bloomberg Terminal. USGG10YR Index (10-Year U.S. Treasury Yield) and TY1 Comdty (10-Year Treasury Note Futures), as of April 10, 2025.

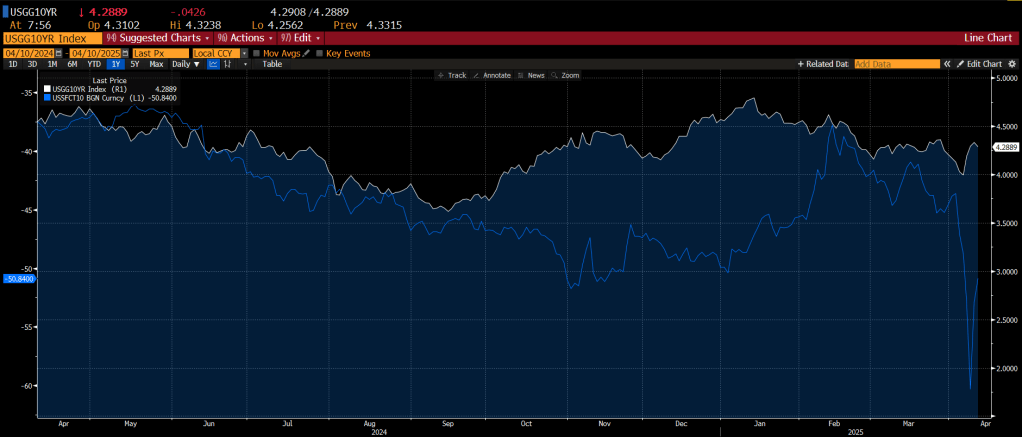

To understand how basis trades contributed to the Treasury market’s volatility in early 2025, it’s essential to look not just at the directional move in yields, but also at the hidden funding pressures that amplified it. The chart below brings these two dimensions together: the 10-year U.S. Treasury yield (USGG10YR Index) captures the market’s response to the macroeconomic shock triggered by aggressive tariffs, while the SOFR–GC repo spread for 10-year collateral (USSFCT10 Index) highlights the growing pressure in short-term funding markets. As yields surged, the repo spread collapsed into deeply negative territory (y-axis on the left), signaling that financing conditions for leveraged positions had deteriorated sharply.

This widening negative spread reflects tightening repo market conditions, signaling that it became increasingly difficult and costly for hedge funds to finance their long Treasury positions. As repo availability shrank and margin requirements rose, leveraged players were forced to liquidate, further fueling the sell-off in Treasuries and amplifying market volatility.

Bloomberg Terminal. Data from USGG10YR Index (10-Year U.S. Treasury Yield) and USSFCT10 Index (SOFR–GC repo spread for 10Y collateral), as of April 10, 2025.

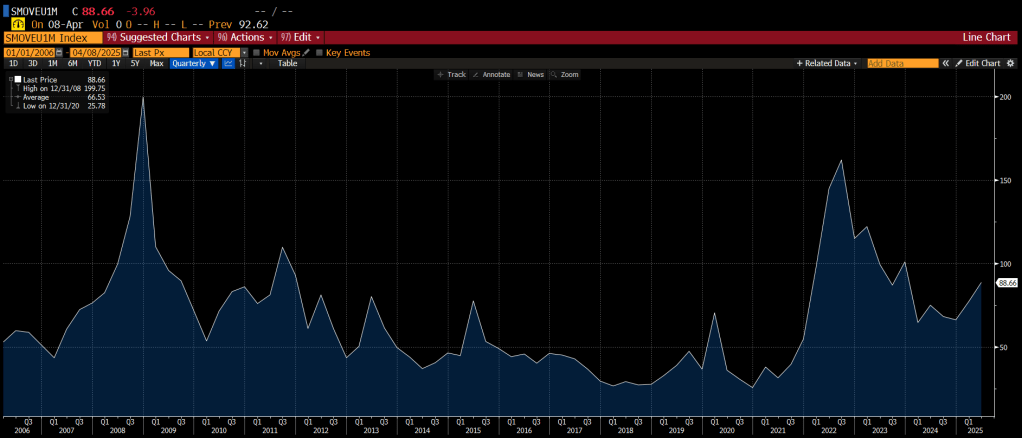

What had started as a rational policy response to trade uncertainty turned into a structural market issue. Liquidity dried up in key segments of the Treasury market. The following chart, depicting the MOVE Index (Merrill Lynch Option Bolatility Estimate), a key gauge of bond market volatility, shows how it spiked to its highest level since the pandemic-era stress of 2020.

Bloomberg Terminal. SMOVEU1M Index (ICE BofAML MOVE Index – 1-Month), showing quarterly observations from January 2006 to April 2025. Last data point as of April 8, 2025

The scale of the problem was significant. According to Apollo´s research, hedge funds had accumulated as much as $800 billion in gross exposure through basis trades. The substantial scale of these positions, in conjunction with their vulnerability to repo market stress and rate fluctuations, transformed them into a systemic risk once the trade deteriorated.

Lessons from 2025

The events of 2025 underscore a critical lesson: basis trades, often viewed as low-risk in calm markets, can become significant sources of instability when conditions shift. Their heavy reliance on leverage and access to short-term funding turns them into amplifiers of stress when volatility strikes.

While tariffs and inflation expectations may have sparked the initial sell-off, they weren’t the whole story. The deeper issue was the structural vulnerability embedded in widely adopted, leveraged strategies. In the aftermath of this market dislocation, basis trades stand out not as the root cause, but as a stark reminder of how seemingly benign strategies can magnify systemic risk, and why even the most routine trades deserve closer scrutiny in uncertain times.

Daniel Rivas

Leave a reply to Tariff Turmoil and the Money Markets: Yet Another Rescue Coming | naked capitalism Cancel reply